Netflix just dropped its Q4 2025 earnings announcing great revenue growth, but the market wasn’t impressed: -5%. While most headlines focused on the $12 billion quarterly revenue beat, one piece of information caught our attention which was quite overlooked: Netflix announced 325 million paid memberships.

You know us, we like analyzing such key revenue drivers… And this one can have important consequences on Netflix.

Is Netflix’s S-Curve approaching its end?

Well, it probably is. First, let’s take a look at what our algorithm says:

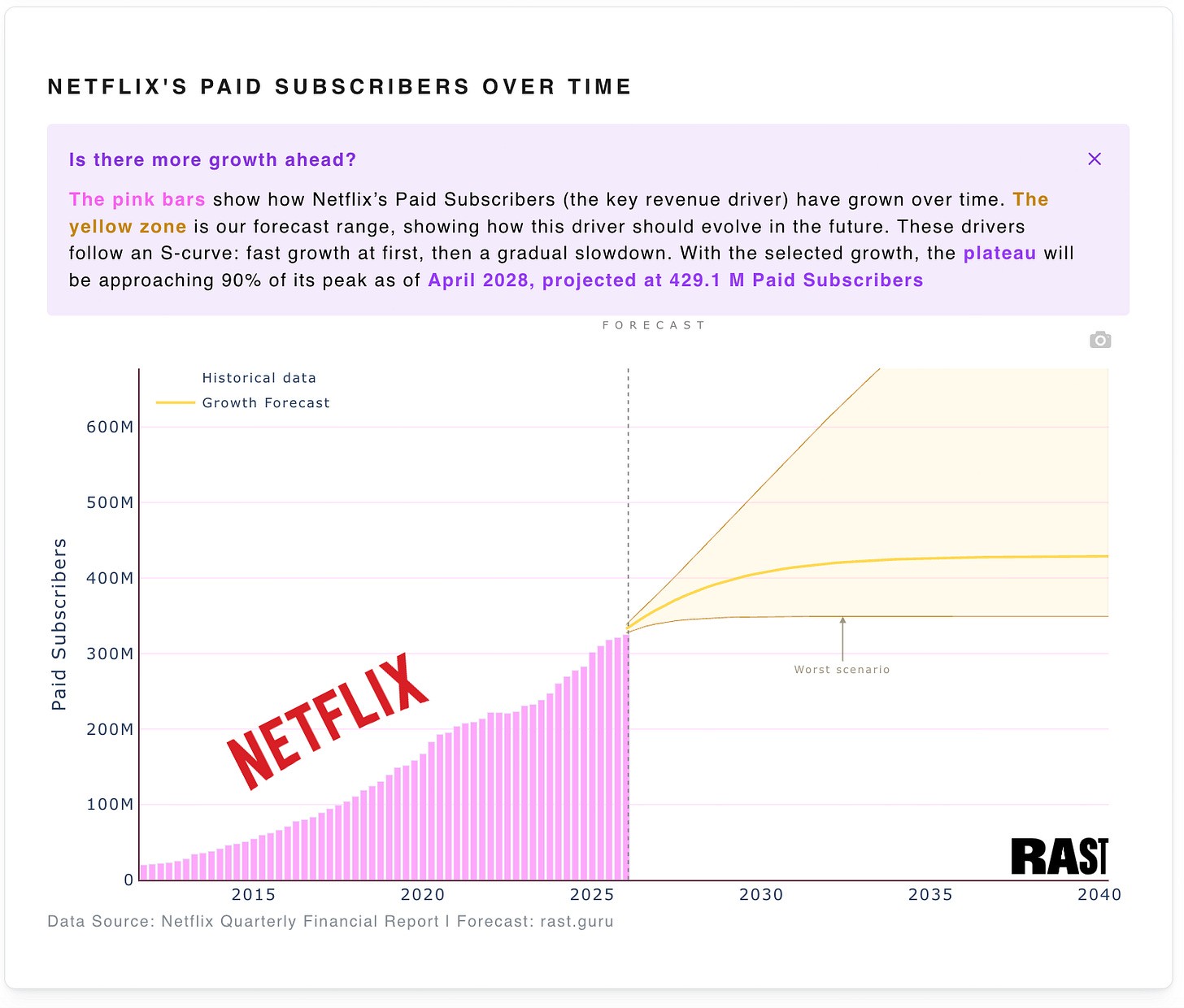

Netflix’s Paid Subscribers’ may start plateauing soon

Netflix’s plateau should approach before 2030 (2027-2029 depending on the scenario*). And this would intuitively make sense: with 325 million paid subscribers, Netflix is now serving an audience that probably approaches one billion people (assuming an average of 3 viewers per account) when accounting for household sharing. Not to mention all the people accessing the content illegally…

There aren’t a lot of people left for "easy" expansion. You may argue that there is, knowing that Meta has 3.5B monthly users… But Meta’s products are free (since you are the product) Netflix isn’t, which considerably lowers the ceiling.

There are at least two additional reasons to think that the Paid Subscribers’ growth may be coming to an end:

Netflix has stopped publishing its paid memberships numbers. The reasons provided are an elegant continuation of… bad arguments: “In our early days, when we had little revenue or profit, membership growth was a strong indicator of our future potential. But now we're generating very substantial profit and free cash flow (FCF)”. Close your eyes and read between the lines to understand “We now prefer to show you only our revenue growth, so that you don’t realize that the growth mainly comes from us increasing the prices instead of gaining more subscribers”.

Its acquisition of Warner Bros (WBD), confirmed in the earnings report (page 7), goes in this direction: obviously WBD’s catalogue is interesting, but the possibility to extend the S-curve’s ceiling artificially is even more attractive (WBD has almost 130M subscribers(!) ).

What’s gonna happen to the share price?

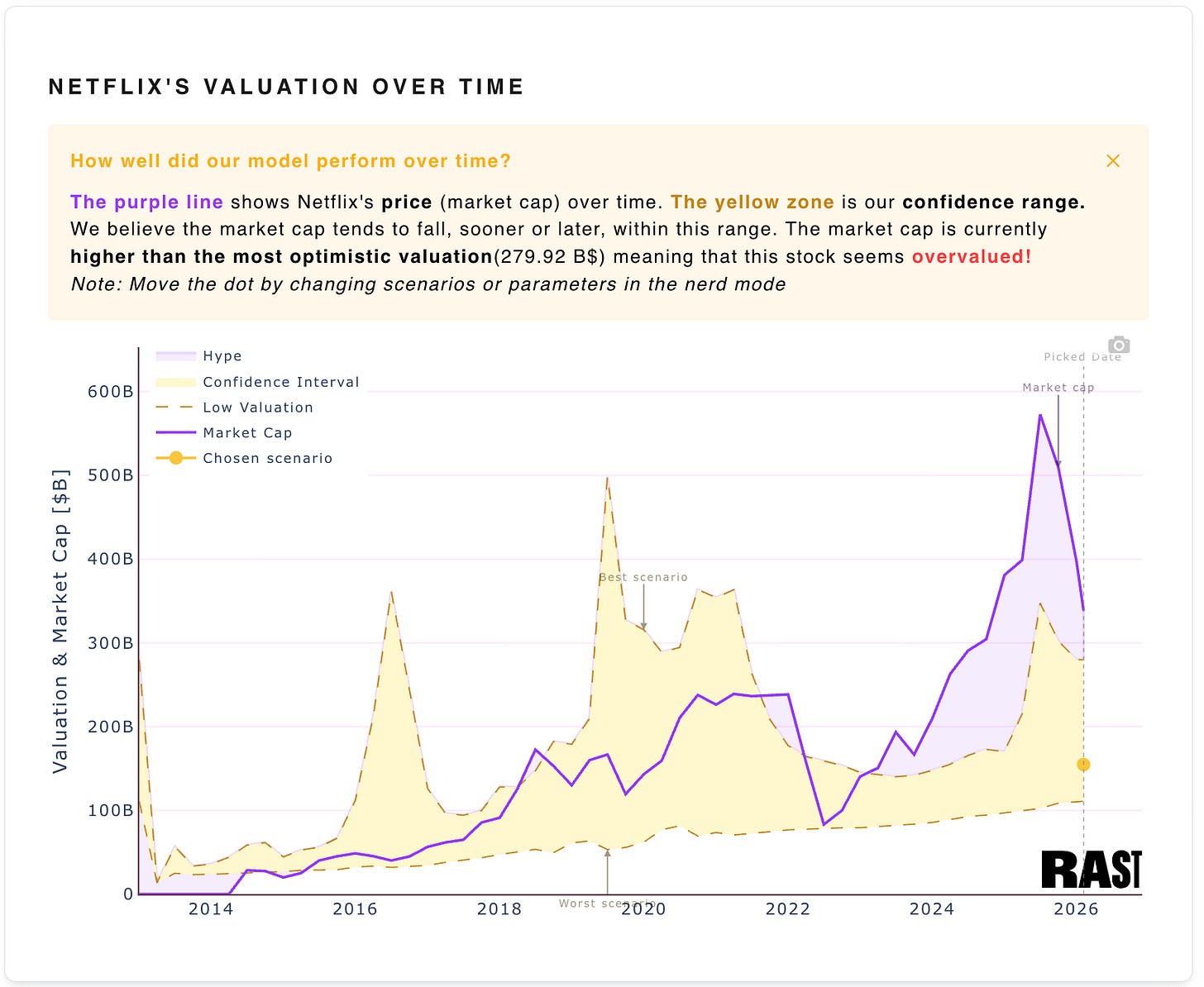

At the risk of disappointing you: not sure. We always believe that the market price tends to come back to our confidence interval, which is clearly happening now.

After 2-3 years of being significantly overvalued, it is finally coming back down to reality.

But Netflix’s price has been overly volatile in its history and it may jump again following a new announcement: AI-generated video games? A new fight announcement between Robots and Jake Paul?

Who knows?