In the world of Big Tech, Meta has had an amazing three-year run: the stock has surged over 600% and people remain bullish.

We know that many people (and probably some of you) will disagree, but we do think it’s still a bit expensive.

While the market seems to be pricing in a future of endless expansion and/or new AI/AR/VR horizons, a look at the fundamentals suggests we might be approaching a ceiling that even AI can’t break through.

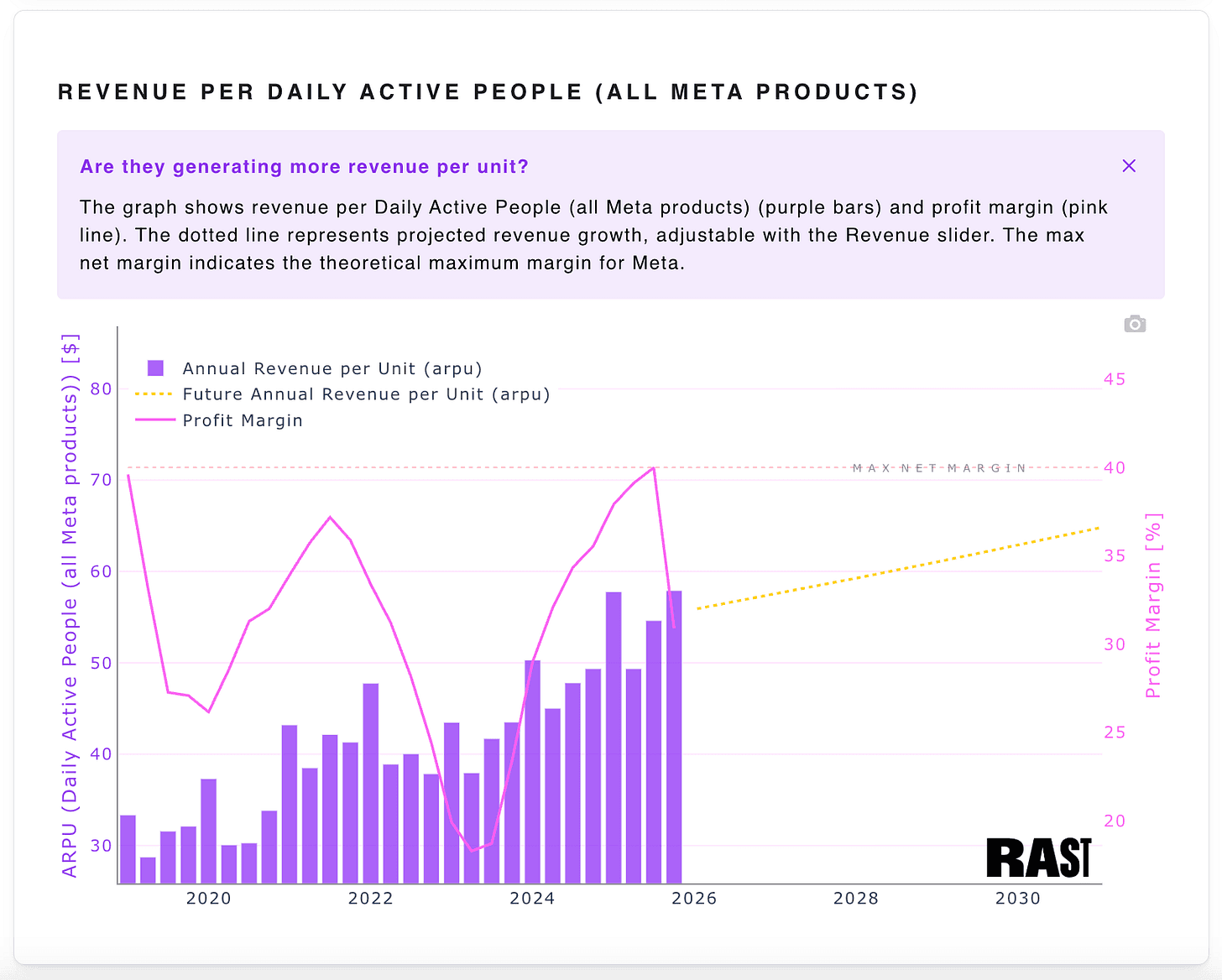

1. The ARPU ceiling: how much more will advertisers pay?

Meta’s primary engine for revenue growth hasn’t just been more people; it’s been extracting more money from the existing base. Their average revenue per user (ARPU) has shown impressive upward momentum.

$META’s revenue per user has been booming… Until when?

But we have to ask: Until when?

Historically, Meta could pump up prices because they had somewhat of a monopoly for high-intent, targeted social advertising. That is no longer the case. No matter your opinion about the trends that come out of it, TikTok offers comparable (if not significantly superior) engagement rates. Advertisers may not accept indefinite price hikes on Meta indefinitely when they have a viable, high-ROI alternative.

If Meta continues to push ad pricing, they risk an advertiser exodus or, at the very least, a thinning of margins. Offer vs. demand, you know the drill.

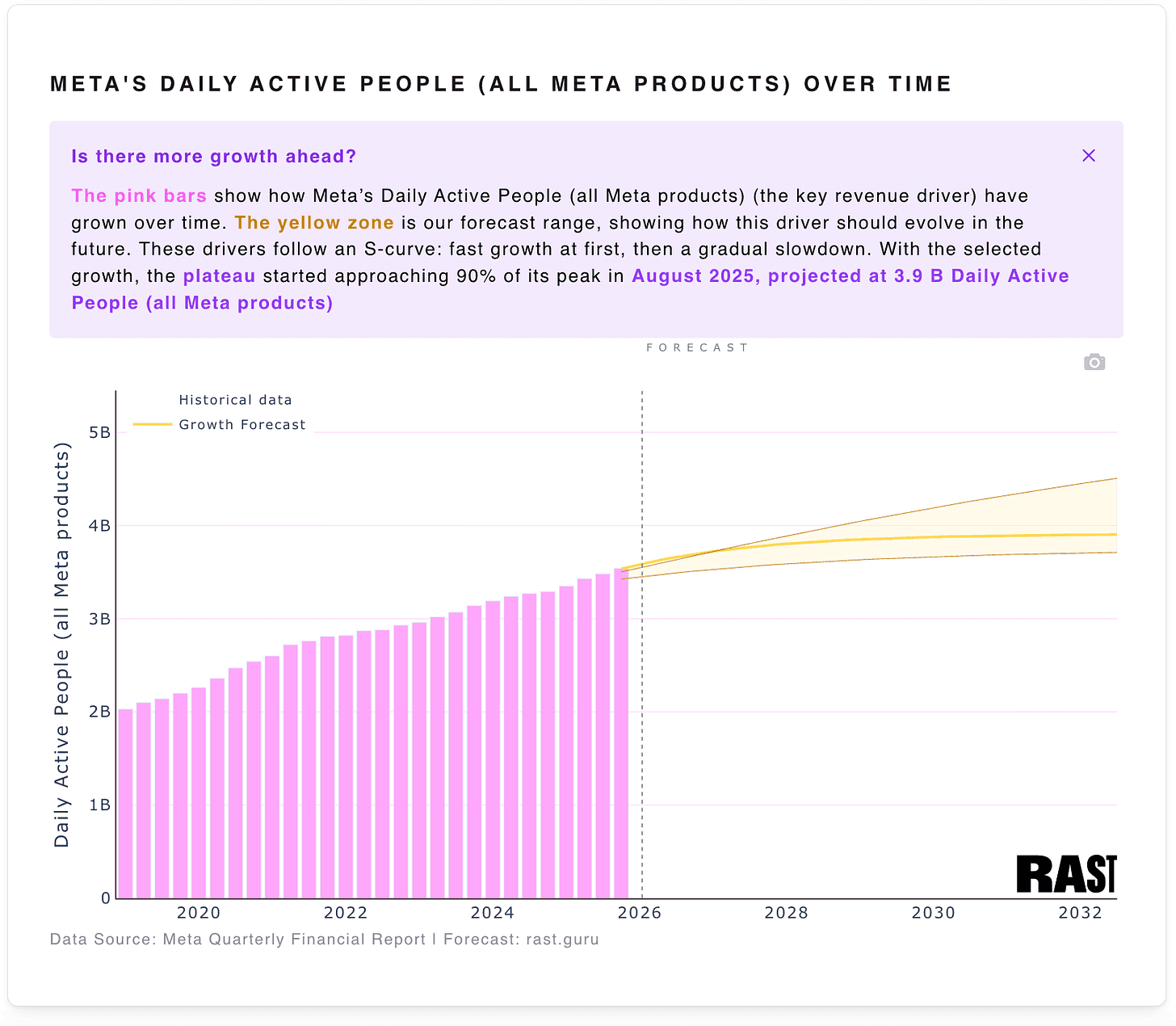

2. The flattening curve

The second pillar of Meta’s valuation is its massive user base. But when you look at the trajectory, the “hockey stick” growth of the 2010s has seriously flattened.

Even $META’s user base hits it ceiling eventually

The reality is that Meta is reaching saturation point in most developed markets. Meta already has 3.54 billion (yes, billion) daily active users. Even though there are 6 billion of internet users worldwide, if you remove China and the right age groups, there aren’t many people left on Earth to onboard.

Future revenue growth will have to come from somewhere else to justify such a price.

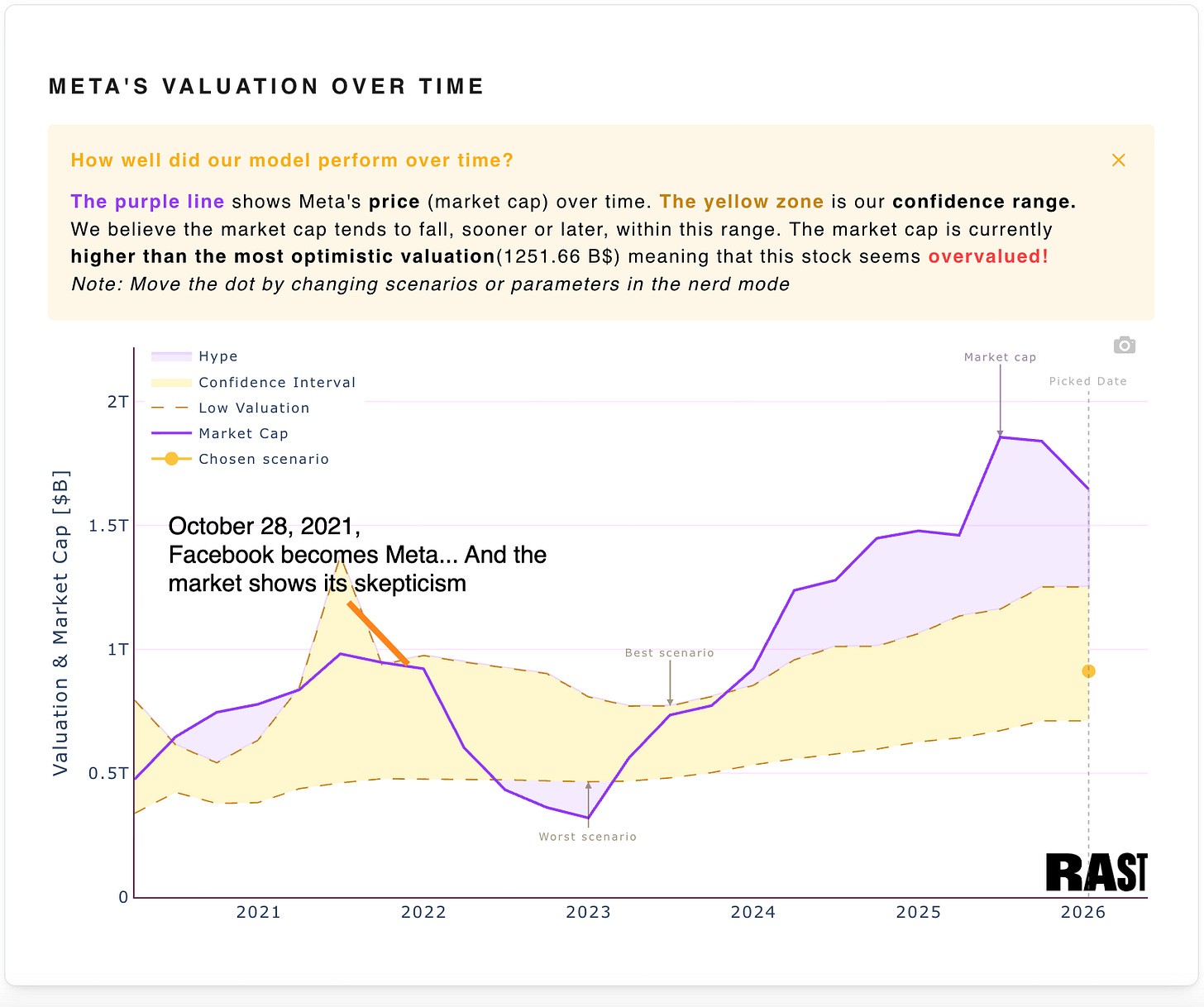

3. Price vs. Fundamental value

The market is currently valuing Meta as more than an just an ad company. Looking at the historical relationship between the company’s intrinsic valuation and its market price, the gap is widening: the price has become disconnected from the company's fundamental ability to generate cash.

$META’s price (purple) has been dancing around our valuation (yellow) for a while.

It hasn’t always been the case though. In Q3 ‘21, when the whole Metaverse plan, rebranding and investments were announced, the market panicked. It panicked so much that Meta was undervalued! But it didn’t last: the price corrected after Zuck decreased spending by laying off people.

But we believe it has now overcorrected. We estimate Meta’s fair value at a maximum of $1.2T, while its market cap is currently $1.6T. What justifies this $400B+ gap?

Ads cannot justify it (both users and revenue are hitting a wall)

AR/VR could boom. But Meta’s Reality Labs is continuously losing a sh*t load of money and glasses are nowhere near competing with smartphones.

AI could generate new revenues for Meta. But in what form? After investing heavily in foundational LLMs under Yann LeCun, Meta finally pivoted by acquiring Manus AI for $2B, a company that actually generates revenue.

Meta’s key lever for revenue growth, raising ad prices, will probably come to an end. The company is hoping that its AI or VR business finally picks up before ads finally hits its ceiling.

However, we find it hard to believe those bets are currently worth $400B, especially given how unproven mass-market AI business models remain.

But as always: “Markets can remain irrational longer than you can remain solvent.”